General Counsel Advice On Becoming A Business Owner

Starting a new business or becoming a business owner is exciting. The entrepreneurial spirit of building a brand, creating a cohesive team, and becoming your own boss is thrilling, trending and maybe even slightly terrifying all at the same time. Or if you have owned your own business for sometime you might be experiencing a different brand of stress and anxiety that might be turned into passion and excitement by bringing in structure you may not even be aware you are missing.

What’s not as trendy or glamorous about becoming your own boss are the documentation, logistics and paperwork that ensure you are protected, supported, and operating as an informed, well-rounded business.

The road to success starts when you ask the right questions, lean on the appropriate experts, and gather the needed documentation to support expansion and growth.

CRUCIAL QUESTIONS BEFORE YOU START

There are a number of questions to ask yourself or your counsel before starting or acquiring a business. The answers will inform on how to proceed and build the portfolio of foundational documents required.

What kind of entity are you?

C-Corp, LLC or S-Corp all have different benefits and fit different purposes. . Depending on your specific type of business, you might be legally required to be a Professional Corporation (PC).Exploring the options with your general counsel will help identify the appropriate entity for the business.

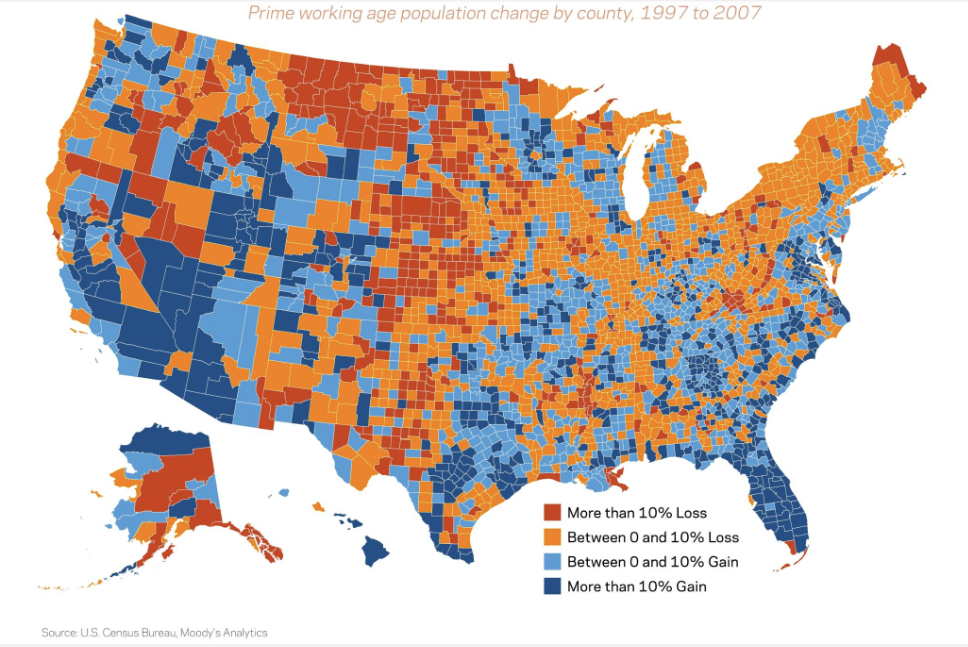

Where will the entity be incorporated?

Interestingly enough, the entity can be formed in any state regardless of the physical location of operation. There may be reasons to claim the state you are in, or otherwise, based on taxes or different distinctions state-to-state. Your general counsel can help determine the best fit based on the business model.

Who else is involved?

If you are starting a business with partners, it is incredibly beneficial to lay out the operating agreement or shareholders’ agreement right away to avoid challenges down the road. Who owns how much? Is everyone putting in the same amount of time and energy? How do we divide ownership? What if someone is investing time while the other is investing money? Is there a buyout agreement? Should partners be able to freely sell their shares if they wish to divest in the future before checking with the other partners?

No matter how the partnership starts or what verbal agreements are made, it’s really important to have these determinations memorialized BEFORE any issues arise.

Do you qualify for a S-Corp elective?

An S-corp election is filed with the Internal Revenue Service (IRS) and changes the way your business is taxed. LLCs are able to elect this status and yet retain their existing entity structure. For certain businesses, this can save the company money. For others, it might not be a legal option even if it is desired.

ASSEMBLE YOUR EXTERNAL TEAM

Of course, we recommend connecting with an attorney to provide general counsel and support the process of starting or acquiring a business – but there are 4 other indispensable relationships that are key to the success of your business.

Aside from the internal team, there are 5 best friends we recommend you acquire as a new business owner. This team is just as integral to your success as the product being sold.

1. Accountant

Needs to understand the nature of your business including everything that is being “sold.”

2. Banker

There needs to be a personal connection here and we can’t emphasize this enough. Especially in the current commercial banking world where everything is automated or online, a relationship with an actual banker is crucial. Guidance, support and an understanding of your business will help navigate whatever comes your way.

3. Insurance Broker

This person will understand how to protect you and your business based on case specific needs. Whether it is health/disability insurance, product liability, professional liability, workers comp, renter’s insurance or another option specific to your business, the right coverage and the right protection is your lifeline in sticky situations.

4. Attorney

This person needs to understand your business and where it’s going so they can ensure you are covered legally. From start-up paperwork to the type of entity, location and operating agreements, trademarks, lease negotiations, employment agreements or services contracts your general counsel will help answer questions you don’t even know you need to ask.

5. Outreach / Marketing Manager

Ensuring you are covered on all the above is a lot. Create the product, manage the staff, keep the place clean, worry about taxes, insurance AND market the business? An external partner who can properly promote your business on the appropriate channels is crucial for growth and expansion down the road.

These partners should be part of your core external team. Identifying people you trust in these roles is just as important as the people who run the day-to-day operations. To be covered on all fronts and run a successful business with steady growth, these 5 relationships are essential.

THE PROPER DOCUMENTATION

The first step to avoiding issues is to have proper legal documentation. As previously mentioned, your general counsel can help identify the entity, location and more, but this becomes especially important when a business has multiple partners.

Below are three examples of common pain points that could benefit from an operating agreement.

Example 1: Loose, Informal Understandings

A verbal understanding that a business is split 50/50 does not have legal standing without a written agreement. One client experienced this exact situation in a partnership that fell apart due to such vagueness. The partners had neglected signing an operating agreement in the beginning when they agreed orally to 50/50 ownership. Later, when taxes were filed, the other partner who completed the tax forms indicated he had 90% ownership while our client was allocated 10%. The other partner argued he was entitled to file it this way because he claimed he had made undocumented additional capital contributions to the company. Down the road there was a parting of ways and the only official record was that tax filing outlining a 90/10 split rather than the informal agreed upon 50/50. Without the operating agreement the tax filing was the only legal document on record.

Example 2: Ownership v. Control

In a situation where one partner has capital and the other has expertise, formal documentation is crucial to differentiate level of ownership vs level of control. Although one may have a larger monetary investment, it might make more sense to allocate control of daily operations to the person with the expertise to actually run the business, rather than a passive investor. Having an operating agreement in place allows owners to disassociate the level of ownership from the level of control.

Scenario 3: The Buyout Protocol

Imagine you’ve had a wonderful working relationship with your partner and suddenly they need to sell their share. Bringing in a stranger or unapproved partial owner with equal share of the business you built isn’t an ideal situation. Outlining a buyout protocol with the proper documentation BEFORE it happens is essential for the long-term success of your business and relationships.

THE ROAD TO SUCCESS

The road to success doesn’t happen overnight, especially if you are going at it alone. Becoming a business owner is challenging and it’s almost impossible to know all the scenarios to plan for.

Asking the right questions and leaning on experts will alleviate potential issues or avoid them all together. Not all of the above are legally required when forming a business. However, to start off in the right direction and avoid undoing things later – it is as easy as setting up a consultation to begin the conversation. Remember, having a good product or a service is only a part of what your business needs to succeed. Chances are, if you took time to become the best dentist, coder, retailer, chef, you might not have had the time to become the best business operator. Leverage the expertise of other professionals to accomplish this today.

Togai Atac is the Managing Member of Atom Law Group. Togai works closely with both robust small US businesses and US subsidiaries of foreign businesses to maximize their business growth.